"Given those macro concerns and LinkedIn's recent execution issues, we expect investors will demand financial outperformance before there is meaningful recovery in LNKD's multiple," Goldman Sachs analysts wrote in a client note. LinkedIn has been spending heavily on expansion by buying companies, hiring sales personnel and growing outside the United States, but is now facing pressure in Europe, the Middle East, Africa and Asia-Pacific due to macro-economic issues. LinkedIn should be trading at $71.79, a 30 percent discount to the stock's Friday's low, according to StarMine's Intrinsic Valuation model, which takes analysts' five-year estimates and models the growth trajectory over a longer period. Twitter Inc (TWTR.N) trades at 29.5 times forward earnings, Facebook Inc (FB.O) at 33.8 times and Alphabet Inc (GOOGL.O) at 20.9 times.Įven after the selloff, LinkedIn's shares may still be overvalued, according to Thomson Reuters StarMine data. "The mediocre employment report from the Labor department just amplified the reaction of anything employment sensitive today."Īs of Thursday, LinkedIn shares were trading at 50 times forward 12-month earnings, making it one of the most expensive stocks in the tech sector. "It's not a great day to have reported tough guidance," said Randle Reece, an analyst with Avondale Partners LLC. LinkedIn's hiring business, called Talent Solutions, is the company's biggest unit by revenue. monthly jobs report, which showed employment gains slowed more than expected in January. Underscoring the slowdown in growth, LinkedIn said online ad revenue growth slowed to 20 percent in the latest quarter from 56 percent a year earlier.Īdding fuel to the selloff was the release of the U.S. "This would imply that LinkedIn will grow around 15 percent in 2017 and 10 percent in 2018," Mizuho analysts said. LinkedIn forecast full-year revenue of $3.60-$3.65 billion, missing the average analyst estimate of $3.91 billion, according to Thomson Reuters I/B/E/S.

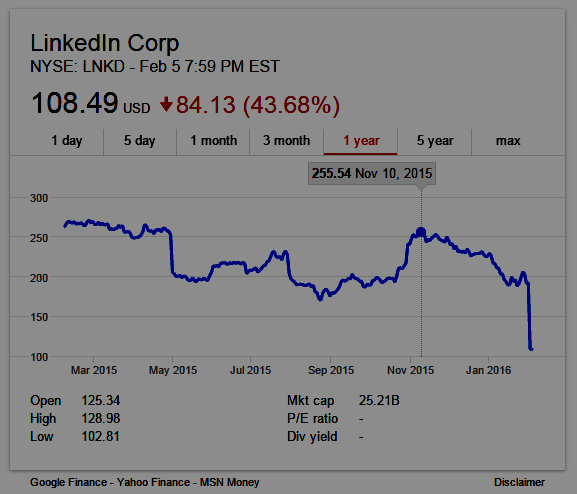

Their median target dropped 34 percent to $188, according to Reuters data. "With a lower growth profile, we believe that LinkedIn should not enjoy the premium multiple it has grown accustomed to," Mizuho Securities USA Inc analysts wrote in a note.Īt least 36 brokerages cut their price targets, with Pacific Crest halving its target to $190. The rout in the stock cost LinkedIn chairman Reid Hoffman about $1.2 billion based on his 11.1 percent stake in the company he co-founded, according to Reuters calculations.Īt least nine brokerages downgraded the stock to "hold" from "buy", saying the company's lofty valuation was no longer justified. The stock plunged as much as 46.5 percent to a more than three-year low of $102.89, registering its sharpest decline since the company's high-profile public listing in 2011.

0 kommentar(er)

0 kommentar(er)