The unemployment rate is now forecast to peak at 4.4%.Īccording to the OBR “The near-term economic downturn is set to be shorter and shallower medium-term output to be higher and the budget deficit and public debt to be lower.” Growth rates for 2025-27 were, however, slightly lower than forecast in November. The OBR still expects that disposable incomes will decline 5.7% between 2022-24, the largest on record. GDP growth is forecast at 1.8% for 2024 followed by growth of 2.5% and 2.1% respectively in the following two years. The OBR now forecasts that GDP will contract 0.2% compared with the previous forecast of a 1.4% contraction. He added "The sell-off in these stocks only raises concerns over financial stability again, which is having a knock-on effect in European government bond and swap markets as the prospect of an more restricted ECB (European Central Bank) comes back into view." Short-Term UK GDP Forecasts RaisedĪccording to the Office for Budget Responsibility (OBR), the UK will now avoid a technical recession of two consecutive quarterly declines. Simon Harvey, Head of FX Analysis at Monex commented "This morning’s Credit Suisse news is doing all of the damage in FX markets as European bank stocks take another beating today." There was fresh turmoil in currency markets with markets switching to expecting no rate hike by the Fed next week and markets also now expect the ECB to limit the rate hike to 25 basis points this week.Īccording to ING “Heavy losses in CS have un-nerved European bank stocks in general at a time when the failure of SVB, formerly the United States' 16th largest bank, is still being assessed.” The Pound to Dollar (GBP/USD) exchange rate posted sharp losses to lows below 1.2050, but the Pound to Euro (GBP/EUR) exchange rate surged to 12-week highs near 1.1470 before settling around 1.1440.Įarly in Europe on Wednesday, a key stakeholder in Credit Suisse announced that it would not increase its stake further and the bank’s share price plunged which dragged the whole sector lower. The FTSE 100 index remained under pressure during the budget speech and traded 3.0% lower on the day as European banking stocks slumped.

There was a cautious market welcome to the macro-economic forecasts, but the overall market reaction was overshadowed by a fresh slide in risk appetite amid fears over the European banking sector. The main focus was on supply-side improvements to boost economic activity rates and labour supply, together with moves to strengthen the economy through higher investment. Hunt focussed on measures to bring headline inflation down, including holding the average household energy costs to £2,500 for the second quarter.

#Live currency rates free#

If I misunderstand your needs or you still have problems on it, please feel free to let me know.UK Chancellor Hunt confirmed that the short-term outlook for the UK has improved with the Office for Budget Responsibility now forecasting that a technical recession will be avoided. If there is any post helps, then please consider Accept it as the solution to help the other members find it more quickly. If I misunderstand your needs or you still have problems on it, please feel free to let me know.

Īlso, attached the sample pbix file as reference.

#Live currency rates how to#

For how to set scheduled refresh, you may refer to Data refresh in Power BI - Power BI | Microsoft Docs.

#Live currency rates update#

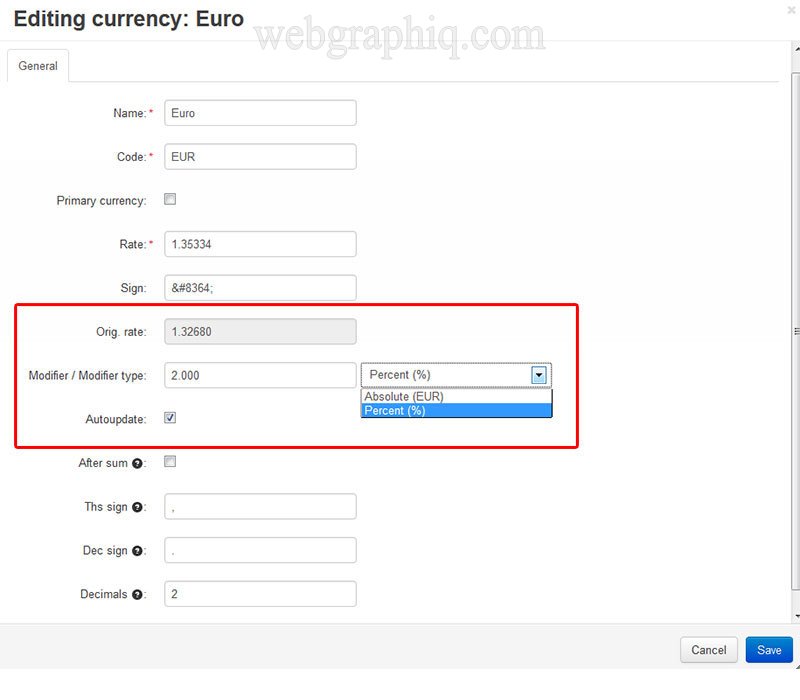

To update the conversion rate and the result of conversion, you need to arrange daily data refresh for your dataset. Then, you need to create a Calculated column to do the conversion for you. When everything is ready, close and apply the transformation in Power Query, and this conversion rate will be imported into your model. Īfter connecting to the data source with Web connector, you need transform the data retrieved to extract the specific conversion rate between USD and CAD in Power Query. In my sample, I get this data from this website. Hi as tomfox said, if you would like to get the fluctuating conversion rate of current day, you need to detch it from a website.

0 kommentar(er)

0 kommentar(er)